The Potential Next Wave of TCPA Litigation: Consent Revocation

The Federal Communications Commission’s (FCC) updated consent revocation rules have opened the door to a new category of potential class actions under the Telephone Consumer Protection Act (TCPA). These changes create fresh opportunities for professional plaintiffs to pursue litigation against companies that fail to comply with revocation standards.

On May 23, 2025, we saw the first notable attempt to leverage these new rules in court. In Saul De La Torre v. American First Finance LLC (Case No. 2:25-cv-01447), filed in the U.S. District Court for the Eastern District of California. The plaintiff alleges that American First Finance (AFF) violated the TCPA by sending text messages after he had attempted to revoke consent.

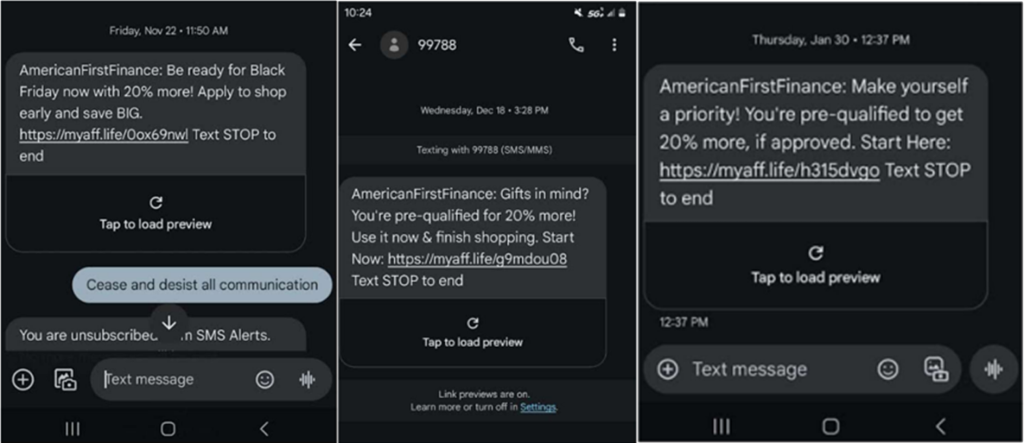

According to the complaint, De La Torre received multiple messages from AFF even after opting out of marketing communications. The filing includes screenshots (below) showing that De La Torre sent a message requesting AFF to “cease and desist all communication,” which triggered an unsubscribe confirmation, despite not being a commonly used opt-out phrase. Although this opt-out language differs from the typical “STOP” response, the FCC’s revised rules make clear that consumers may revoke consent through any reasonable means.

Key Compliance Takeaways from the FCC’s Consent Revocation Rules

To stay ahead of potential litigation, companies should review and strengthen their compliance processes. The FCC’s new rules emphasize three core obligations:

Revocation by Any Reasonable Means:

Consumers may withdraw consent through any method that clearly expresses their intent, including text messages, verbal statements, emails, or written requests. Businesses can no longer insist on specific keywords or formats.

Timely Processing of Opt-Outs:

Consent revocations must be honored within 10 business days, a notable acceleration from the previous 30-day window.

Permissible Confirmation Messages:

Senders are allowed to issue a one-time confirmation acknowledging the opt-out, provided it contains no marketing or promotional content.

Recognizing the operational burden these updates may pose, the FCC has issued a limited one-year waiver for a specific aspect of the rules. Until April 11, 2026, businesses are not required to treat a revocation made in response to one type of message as applying universally to all forms of communication from the sender.

Why Torre v. AFF Matters

This case represents an early test of the FCC’s new revocation standards—and a clear signal that plaintiffs are ready to exploit noncompliance. For businesses engaging in outbound communications, especially those that rely heavily on marketing via phone or text, this is a timely reminder to:

- Audit consent management workflows

- Ensure opt-outs are captured and actioned promptly

- Eliminate friction from the opt-out process

- Train customer service and marketing teams on updated rules

Failure to comply not only invites lawsuits like Torre v. American First Finance LLC, but also risks financial penalties, regulatory scrutiny, and reputational harm.

Learn more by watching our Where so FCC Consent Revocation Rules Stand? podcast episode.

CompliancePoint has a team of experts dedicated to helping businesses comply with all aspects of the TCPA, TSR, and state telemarketing laws. Contact us at connect@compliancepoint.com to learn more about our services.

Finding a credible expert with the appropriate background, expertise, and credentials can be difficult. CompliancePoint is here to help.