Common Remediation Items Found in PCI DSS Audits

Achieving and maintaining PCI DSS compliance requires more than completing an annual assessment—it requires security controls that are consistently implemented, governed, and evidenced. Whether an organization completes a Report on Compliance (RoC) or Self-assessment Questionnaire (SAQ), PCI audits frequently uncover gaps that must be remediated before compliance can be achieved or maintained.

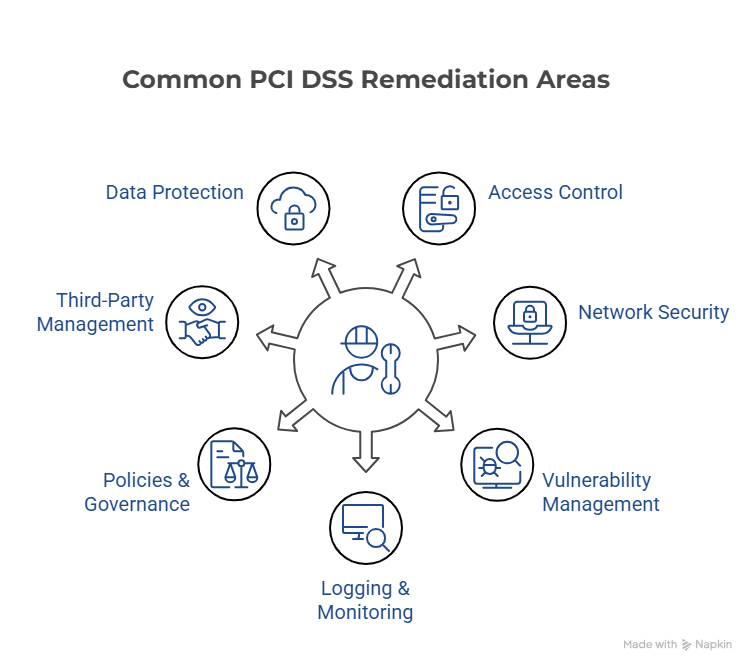

While many findings are technical in nature, the most common remediation items stem from gaps in governance, documentation, and operational consistency. Below are the areas most frequently identified during PCI DSS audits, reflecting common trends under PCI DSS v4.0.1.

Your organization’s audit will likely reveal aspects of its security program that fall short of PCI standards, often due to inconsistent implementation, insufficient documentation, or lack of supporting evidence. These items will require remediation to achieve certification.

In this article, we’ll explore the common remediation items found in PCI audits. We’ll also provide steps organizations can take to avoid or reduce these findings before an audit. These actions reflect commonly observed best practices and do not represent additional PCI DSS requirements. Organizations that address these areas before an assessment consistently experience fewer remediation items, faster report issuance, and lower overall compliance costs.

Access Control & Identity Management

Audits commonly reveal that users are granted access to the cardholder data environment (CDE) beyond what is required for their job responsibilities. Shared or generic accounts continue to be identified, along with missing or undocumented quarterly access reviews where required. Incomplete enforcement of multi-factor authentication—particularly for administrative access, cloud management consoles, and remote access paths—remains a frequent issue.

Under PCI DSS v4.0.1, assessors place increased emphasis on demonstrating that access controls are not only configured correctly, but are consistently enforced, reviewed, and evidenced.

Steps to reduce access control and identify management findings include:

- Perform and document quarterly user access reviews

- Eliminate shared and generic accounts

- Validate MFA enforcement for all required access paths

- Document access approval and termination workflows

Network Security & PCI Scope Management

PCI DSS does not require organizations to implement network segmentation. However, when segmentation is relied upon to reduce PCI scope, it must be properly designed, documented, and validated.

Audits frequently uncover:

- Unclear or inaccurately defined PCI scope

- Missing or outdated network and data flow diagrams

- Firewall and router rule sets that have not been reviewed at least every six months

- Overly permissive inbound or outbound rules

- Segmentation controls that exist architecturally but lack evidence of effectiveness

When segmentation is relied upon, organizations must be able to demonstrate its effectiveness through testing or other validation methods appropriate to the environment. When scope is poorly defined or segmentation is incomplete, organizations often experience unexpected scope expansion, increased testing effort, and additional remediation.

Steps to take to avoid these issues include:

- Explicitly define PCI scope, including what is in-scope and out-of-scope

- Maintain current network and data flow diagrams

- Review firewall and router rule sets at least every six months

- If segmentation is used, validate effectiveness and retain supporting evidence

Vulnerability & Patch Management

Common findings include missed quarterly vulnerability scans, failure to remediate high or critical-risk vulnerabilities within required timelines, and penetration testing that is incomplete, improperly scoped, or not performed following significant changes. Patch management processes are often informal, inconsistently followed, or insufficiently documented. The presence of unsupported or end-of-life systems within the CDE frequently results in significant remediation requirements.

PCI DSS v4.0.1 places greater emphasis on risk-based vulnerability management, making consistency, timeliness, and documentation critical.

Actions to avoid vulnerability items include:

- Schedule quarterly vulnerability scans in advance

- Track remediation timelines for high- and critical-risk findings

- Document patching cadence and exception handling

- Identify and plan for the removal of end-of-life systems early

Logging, Monitoring & Alerting

Logging-related gaps remain among the most frequently cited PCI findings. Organizations often fail to retain logs for at least one year, or cannot readily produce the most recent three months of logs. Daily log review requirements are commonly unmet or lack sufficient evidence. Time synchronization issues across systems can further undermine log integrity, and alerting mechanisms for suspicious or high-risk activity are often missing or not operationally monitored.

From an audit perspective, alerts that are generated but not reviewed, escalated, and documented are treated as ineffective controls.

Steps to minimize these issues include:

- Confirm logs are retained for at least one year

- Ensure the most recent three months of logs are immediately accessible

- Document daily log review procedures

- Validate alerting and escalation workflows

Policies, Procedures & Governance

Even organizations with mature technical controls often struggle with governance-related findings. Common issues include policies that are not reviewed and approved annually, procedures that do not reflect actual operational practices, missing or outdated risk assessments appropriate to the organization’s environment, and incident response plans that have not been tested.

In many cases, controls exist in practice but fail during an audit due to incomplete documentation or lack of formal review.

Best practices to avoid these findings include:

- Review and approve policies annually

- Align written procedures with actual operational practices

- Perform an annual risk assessment

- Test incident response plans and retain evidence of testing

Third-Party & Service Provider Management

Audits frequently identify weaknesses in vendor oversight, including:

- Missing or insufficient PCI responsibility language in contracts or equivalent written agreements

- Lack of a centralized inventory of service providers with access to cardholder data

- Missing or outdated evidence of service provider PCI compliance, such as Attestations of Compliance (AOCs)

PCI DSS v4.0.1 increases expectations around ongoing service provider validation rather than point-in-time verification.

Proactive third-party actions include:

- Maintain a current inventory of service providers

- Verify PCI responsibility language in vendor contracts or agreements

- Collect and track vendor compliance evidence annually

Data Protection & Retention

Many organizations discover during an audit that they are unnecessarily storing cardholder data or retaining it longer than required. Inadequate encryption for data at rest or in transit is another common finding. Reducing stored cardholder data remains one of the most effective ways to lower both risk and PCI scope.

Recommended pre-audit data protection and retention actions include:

- Eliminate unnecessary cardholder data storage

- Validate strong encryption at rest and in transit

- Document data retention and secure disposal processes

Final Takeaway

Across all these areas, the most consistent challenge organizations face is providing evidence that a control is operational. Even mature security programs can struggle during a PCI audit if processes are informal or documentation is incomplete. By focusing on clearly defined procedures, repeatable processes, and centralized evidence collection, organizations can significantly reduce common PCI remediation findings and approach audits with greater confidence.

CompliancePoint is an authorized PCI QSA. We have helped organizations of all sizes and in many industries navigate every step of the PCI DSS certification process. Contact us at connect@compliancepoint.com to learn more about how we can help your business achieve its PCI goals.

Finding a credible expert with the appropriate background, expertise, and credentials can be difficult. CompliancePoint is here to help.