Cautionary TCPA Tale for Debt Collectors

The rules governing how and when a debt collector may contact debtors are largely derived from the FTC, the Fair Debt Collection Practices Act, and the FCC’s Telephone Consumer Protection Act. While the FDCPA has been in effect for over forty years, the FCC’s TCPA is the consumer contact regulation with the most bite. Although this law applies primarily to telemarketing activities, debt collectors can be held liable for violations of the TCPA if they make autodialed or pre-recorded calls to consumers without first obtaining express consent.1 Additionally, debt collectors who make those calls must have procedures and documentation to demonstrate that express consent was obtained prior to making the call.2 Penalties for TCPA violations can range from $500 to $1500 per violative call. With class action lawsuits increasingly prevalent, penalties from these cases can be devastating.

The threat of these damages is real. In the past decade, consumer protection litigation has been on the rise and class actions have nearly tripled.3 Although the FDCPA made up 72% of consumer protection lawsuits filed during that time period, TCPA claims increased by more than 700%. With consumer debt nearing all-time highs4 (nearly 30% of all Americans with a credit report having at least one debt in collections) the TCPA cannot and should not be ignored.5

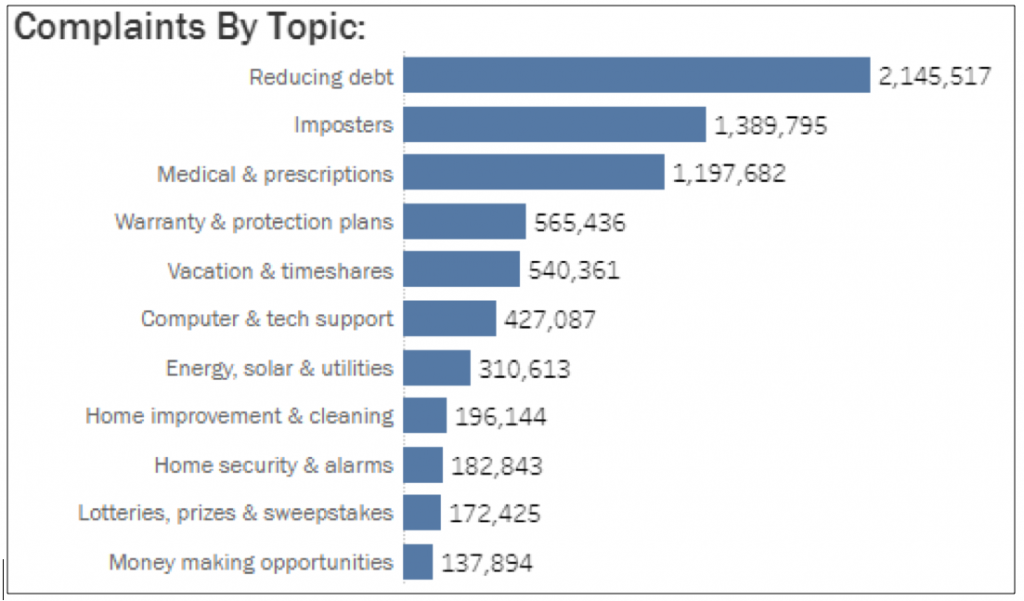

Consumers are now more aware than ever of their protective

rights. Further, they know how to file lawsuits and complaints as evidenced

below. The FTC published its complaints received over the past few years by

topic:

As a quick example, the Northern District of California in McMillion v. Rash[1] entered a $267 million-dollar class action judgment against a debt collector for illegally calling numbers acquired through skip tracing. The plaintiffs involved in the suit did not dispute that the debt was owed, only that the consumers were called on their cellphones without permission. This case, and others like it, are illustrative of the treacherous regulatory environment debt collectors find themselves in today. Even conduct that seems justified, like contacting a consumer about delinquent debt, can result in significant penalties.

Under both the FDCPA and the TCPA, debt collectors may

escape liability for violations if they are able to show that the violation was

made in error and arose despite a robust compliance program reasonably designed

to avoid such errors – “Safe Harbor”. Building a Safe Harbor framework may be a

heavy, initial load, but is certainly worth the protection it affords. Further,

most Safe Harbor components are regulatory requirements for collectors (e.g.

obtaining consent to contact). With the increased prevalence of class action

lawsuits in both the FDCPA and TCPA space, debt collectors can no longer look

the other way when it comes to consumer contact compliance.

1 The FCC has stated that a person who “knowingly releases their phone numbers have in effect given their invitation or permission to be called at the number which they have given, absent instructions to the contrary,” in addition to providing written or oral consent.

2 FCC amicus brief filed in Alber A. Nigro v. Mercantile Adjustment Bureau, LLC

3 https://www.legalreader.com/lex-machinas-consumer-protection-litigation-report-reveals-billions-in-damages/

4 https://www.insidearm.com/news/00045388-debt-collection-and-modern- communication-/

5 https://files.consumerfinance.gov/f/documents/201907_cfpb_third-party-debt-collections_report.pdf

Finding a credible expert with the appropriate background, expertise, and credentials can be difficult. CompliancePoint is here to help.